Essay

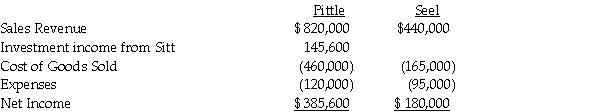

Pittle Corporation acquired a 80% interest in Seel Corporation at a cost equal to 80% of the book value of Seel's net assets several years ago.At the time of purchase,the fair value and book value of Seel's assets and liabilities were equal.Pittle purchases its entire inventory from Seel at 150% of Seel's cost.During 2014,Seel sold $490,000 of merchandise to Pittle.Pittle's beginning and ending inventories for 2014 were $72,000 and $66,000,respectively.Income statement information for both companies for 2014 is as follows:

Required:

Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Preliminar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Preen Corporation acquired a 60% interest in

Q21: Pastern Industries has an 80% ownership stake

Q23: A parent company regularly sells merchandise to

Q24: Plover Corporation acquired 80% of Sink Inc.equity

Q26: Proman Manufacturing owns a 90% interest in

Q28: Paulee Corporation paid $24,800 for an 80%

Q29: Peel Corporation acquired a 80% interest in

Q30: Perry Instruments International purchased 75% of the

Q37: Use the following information to answer the

Q38: On January 1,2014,Plastam Industries acquired an 80%