Essay

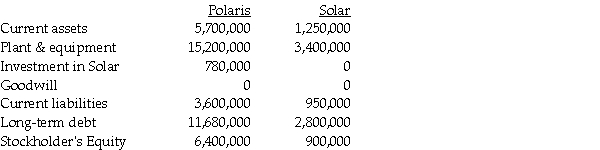

Polaris Incorporated purchased 80% of The Solar Company on January 2,2014,when Solar's book value was $800,000.Polaris paid $700,000 for their acquisition,and the fair value of noncontrolling interest was $175,000.At the date of acquisition,the fair value and book value of Solar's identifiable assets and liabilities were equal.At the end of the year,the separate companies reported the following balances:

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31,2014.

Requirement 2: Assuming that Solar has paid no dividends during the year,what is the ending balance of the noncontrolling interest in the subsidiary?

Correct Answer:

Verified

Requirement 1:

Current Assets = 5,700,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Current Assets = 5,700,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: In the consolidated income statement of Wattlebird

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q25: Passerby International purchased 80% of Standaround Company's

Q27: What method must be used if FASB

Q28: Pal Corporation paid $5,000 for a 60%

Q29: From the standpoint of accounting theory,which of

Q31: Pool Industries paid $540,000 to purchase 75%

Q32: Passcode Incorporated acquired 90% of Safe Systems

Q37: Percy Inc.acquired 80% of the outstanding stock

Q38: On July 1,2014,Polliwog Incorporated paid cash for