Essay

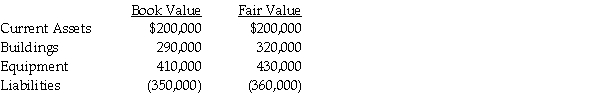

Passcode Incorporated acquired 90% of Safe Systems International for $540,000,the market value at that time.On the date of acquisition,Safe Systems showed the following balances on their ledger:

Safe Systems has determined that their buildings have a remaining life of 10 years,and their equipment has a remaining useful life of 8 years.

Requirement 1: Calculate the amount of goodwill that will appear on the general ledger of Passcode and Safe Systems,as well as the amount that will appear on the consolidated financial statements.

Requirement 2: Calculate the amount of amortization that will appear on the consolidated financial statements for buildings and equipment,and explain how this amortization of excess fair value is shown on the separate general ledgers of Passcode and Safe Systems.

Correct Answer:

Verified

Requirement 1:

The consolidated financia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The consolidated financia...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q27: What method must be used if FASB

Q28: Pal Corporation paid $5,000 for a 60%

Q29: From the standpoint of accounting theory,which of

Q30: Polaris Incorporated purchased 80% of The Solar

Q31: Pool Industries paid $540,000 to purchase 75%

Q31: Pental Corporation bought 90% of Sedacor Company's

Q36: Petra Corporation paid $500,000 for 80% of

Q37: Percy Inc.acquired 80% of the outstanding stock

Q38: On July 1,2014,Polliwog Incorporated paid cash for