Essay

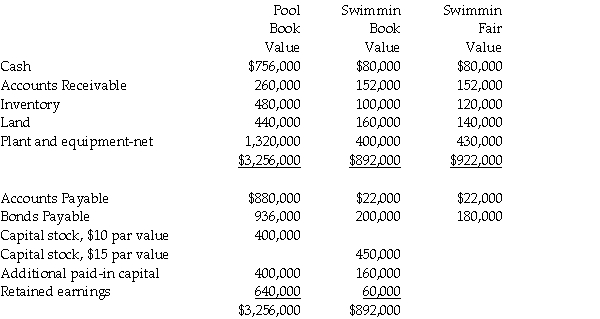

Pool Industries paid $540,000 to purchase 75% of the outstanding stock of Swimmin Corporation,on December 31,2014.Any excess fair value over the identified assets and liabilities is attributed to goodwill.The following year-end information was available just before the purchase:

Required:

1.Prepare Pool's consolidated balance sheet on December 31,2014.

Correct Answer:

Verified

Requirement 1:

Preli...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Preli...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: In the consolidated income statement of Wattlebird

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q27: What method must be used if FASB

Q28: Pal Corporation paid $5,000 for a 60%

Q29: From the standpoint of accounting theory,which of

Q30: Polaris Incorporated purchased 80% of The Solar

Q32: Passcode Incorporated acquired 90% of Safe Systems

Q36: Petra Corporation paid $500,000 for 80% of

Q37: Percy Inc.acquired 80% of the outstanding stock

Q38: On July 1,2014,Polliwog Incorporated paid cash for