Essay

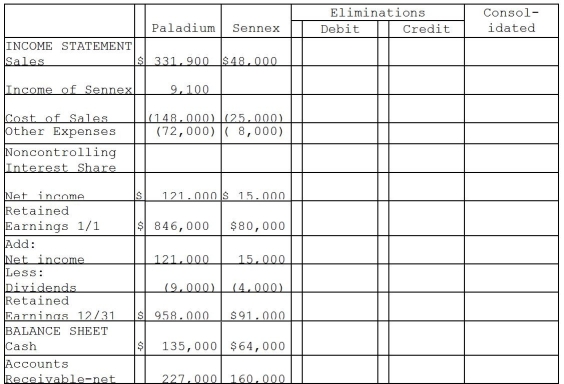

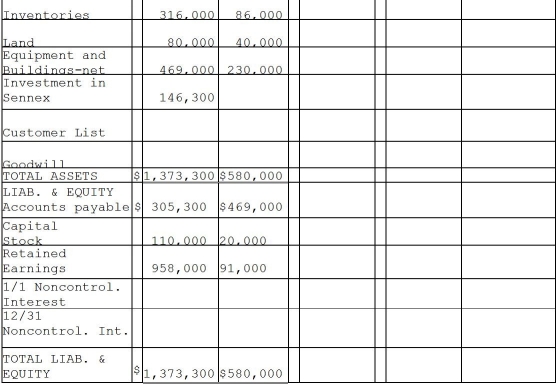

On December 31,2014,Paladium International purchased 70% of the outstanding common stock of Sennex Chemical.Paladium paid $140,000 for the shares and determined that the fair value of all recorded Sennex assets and liabilities approximated their book values,with the exception of a customer list that was not recorded and had a fair value of $10,000,and an expected remaining useful life of 5 years.At the time of purchase,Sennex had stockholders' equity consisting of capital stock amounting to $20,000 and retained earnings amounting to $80,000.Any remaining excess fair value was attributed to goodwill.The separate financial statements at December 31,2015 appear in the first two columns of the consolidation workpapers shown below.

Required:

Complete the consolidation working papers for Paladium and Sennex for the year 2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Adjustments made for consolidation statements impact both

Q41: Powell Corporation acquired 90% of the voting

Q42: A parent company uses the equity method

Q43: The portion of a subsidiary's net income

Q44: Which one of the following will increase

Q45: The consolidated cash flow statement is prepared

Q46: Pull Incorporated and Shove Company reported summarized

Q47: Packo Company acquired all the voting stock

Q48: When preparing consolidated financial statements,which of the

Q49: Parrot Corporation acquired 90% of Swallow Co.on