Multiple Choice

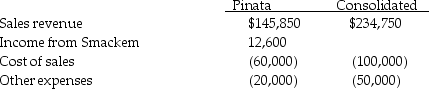

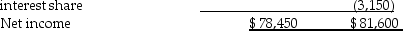

Pinata Corporation acquired an 80% interest in Smackem Inc.for $130,000 on January 1,2014,when Smackem had Capital Stock of $125,000 and Retained Earnings of $25,000.Assume the fair value and book value of Smackem's net assets were equal on January 1,2014.Pinata's separate income statement and a consolidated income statement for Pinata and Subsidiary as of December 31,2014,are shown below.  Noncontrolling

Noncontrolling Smackem's separate income statement must have reported net income of

Smackem's separate income statement must have reported net income of

A) $13,750.

B) $14,750.

C) $15,750.

D) $15,250.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The excess of fair value over book

Q24: Pal Corporation paid $5,000 for a 60%

Q25: On January 2,2014,Power Incorporated paid $630,000 for

Q26: Petra Corporation paid $500,000 for 80% of

Q27: Pardo Corporation paid $140,000 for a 70%

Q29: From the standpoint of accounting theory,which of

Q30: On January 1,2014,Packaging International purchased 90% of

Q31: Pental Corporation bought 90% of Sedacor Company's

Q32: Pattalle Co.purchases Senday,Inc.on January 1 of the

Q33: On July 1,2014,Piper Corporation issued 23,000 shares