Essay

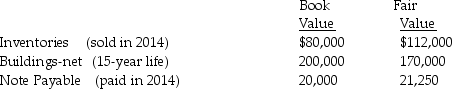

Petra Corporation paid $500,000 for 80% of the outstanding voting common stock of Sizable Corporation on January 2,2014 when the book value of Sizable's net assets was $460,000.The fair values of Sizable's identifiable net assets were equal to their book values except as indicated below.

Sizable reported net income of $75,000 during 2014; dividends of $35,000 were declared and paid during the year.

Sizable reported net income of $75,000 during 2014; dividends of $35,000 were declared and paid during the year.

Required:

1.Prepare a schedule to allocate the fair value/book value differential to the specific identifiable assets and liabilities.

2.Determine Petra's income from Sizable for 2014.

3.Determine the correct balance in the Investment in Sizable account as of December 31,2014.

Correct Answer:

Verified

Preliminary computations

Requirement 1...

Requirement 1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Polaris Incorporated purchased 80% of The Solar

Q22: A parent's income from subsidiary investments can

Q23: The excess of fair value over book

Q24: Pal Corporation paid $5,000 for a 60%

Q25: On January 2,2014,Power Incorporated paid $630,000 for

Q27: Pardo Corporation paid $140,000 for a 70%

Q28: Pinata Corporation acquired an 80% interest in

Q29: From the standpoint of accounting theory,which of

Q30: On January 1,2014,Packaging International purchased 90% of

Q31: Pental Corporation bought 90% of Sedacor Company's