Essay

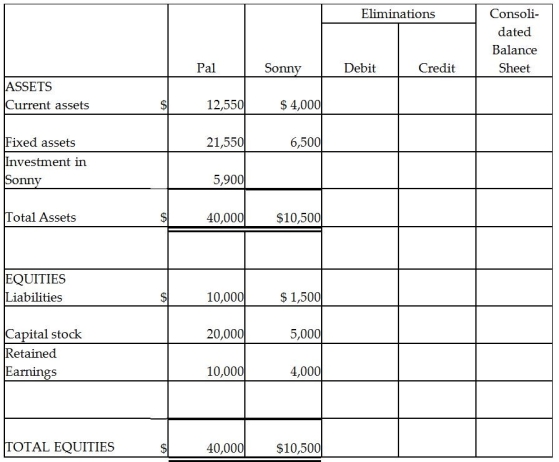

Pal Corporation paid $5,000 for a 60% interest in Sonny Inc.on January 1,2014 when Sonny's stockholders' equity consisted of $5,000 Capital Stock and $2,500 Retained Earnings.The fair value and book value of Sonny's assets and liabilities were equal on this date.Two years later,on December 31,2015,the balance sheets of Pal and Sonny are summarized as follows:

Required:

Required:

Complete the consolidated balance sheet working papers for Pal Corporation and Subsidiary at December 31,2015.

Correct Answer:

Verified

Preliminary computat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q20: Pool Industries paid $540,000 to purchase 75%

Q21: Polaris Incorporated purchased 80% of The Solar

Q22: A parent's income from subsidiary investments can

Q23: The excess of fair value over book

Q25: On January 2,2014,Power Incorporated paid $630,000 for

Q26: Petra Corporation paid $500,000 for 80% of

Q27: Pardo Corporation paid $140,000 for a 70%

Q28: Pinata Corporation acquired an 80% interest in

Q29: From the standpoint of accounting theory,which of