Multiple Choice

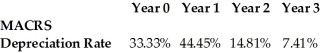

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

A) $28,559

B) $47,599

C) $76,158

D) $190,321

Correct Answer:

Verified

Correct Answer:

Verified

Q41: A maker of kitchenware is planning on

Q43: You are considering adding a microbrewery onto

Q44: The Sisyphean Corporation is considering investing in

Q45: Shepard Industries is evaluating a proposal to

Q47: The Sisyphean Corporation is considering investing in

Q48: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" MACRS

Q49: Which of the following formulas will correctly

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A bakery invests

Q51: Temporary Housing Services Incorporated (THSI) is considering

Q110: How are the taxes paid under MACRS