Multiple Choice

MACRS

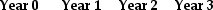

MACRS A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

A) $0

B) $24,083

C) $48,166

D) $300,918

Correct Answer:

Verified

Correct Answer:

Verified

Q43: You are considering adding a microbrewery onto

Q44: The Sisyphean Corporation is considering investing in

Q45: Shepard Industries is evaluating a proposal to

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A fast-food company

Q47: The Sisyphean Corporation is considering investing in

Q49: Which of the following formulas will correctly

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A bakery invests

Q51: Temporary Housing Services Incorporated (THSI) is considering

Q52: Which of the following is usually NOT

Q53: A company spends $20 million researching whether