Multiple Choice

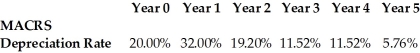

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A) $11,520

B) $9480

C) $3792

D) $17,208

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Shepard Industries is evaluating a proposal to

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A fast-food company

Q47: The Sisyphean Corporation is considering investing in

Q48: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" MACRS

Q49: Which of the following formulas will correctly

Q51: Temporary Housing Services Incorporated (THSI) is considering

Q52: Which of the following is usually NOT

Q53: A company spends $20 million researching whether

Q54: The Sisyphean Corporation is considering investing in

Q55: An exploration of the effect of changing