Essay

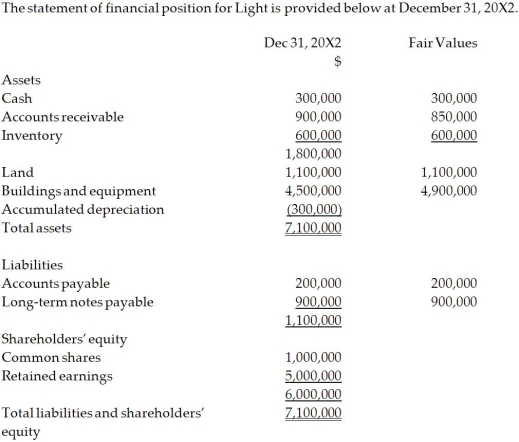

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

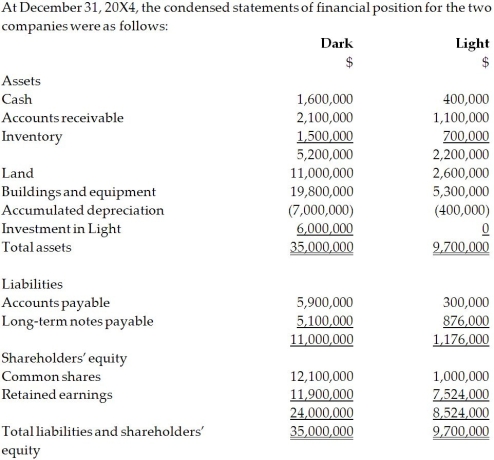

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000 while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

Calculate the non-controlling interest on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Calculate the NCI's share of earnings for 20X4.

Correct Answer:

Verified

Entity Method  Non-controlling interest ...

Non-controlling interest ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Portia Ltd. acquired 80% of Siro Ltd.

Q32: On December 31, 20X6, the statements

Q33: A parent company chooses to acquire only

Q34: Taguchi Ltd. owns 80% of Shag

Q35: Under IAS 27, where does the non-controlling

Q36: Arnez Ltd. acquired 70% of Bedard Ltd.

Q38: Amber Ltd. purchased 80% of Patel Ltd.

Q39: On December 31, 20X2, Dark Company

Q40: Under ASPE reporting requirements for investments in

Q41: Fleming Ltd. acquired 75% of Donner Ltd.