Essay

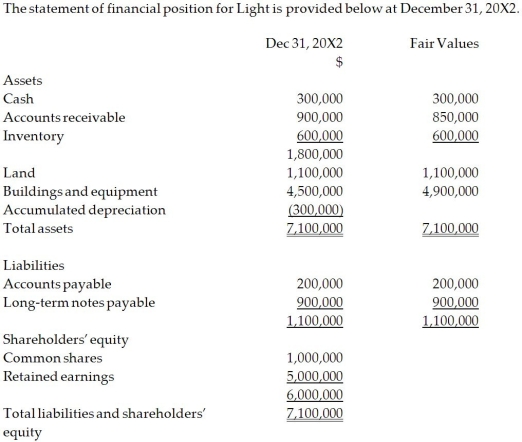

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

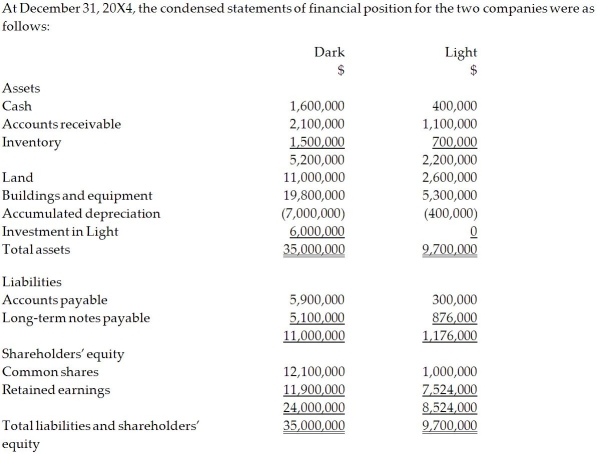

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000, while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

Calculate the retained earnings balance on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Prepare the consolidated statement of financial position at December 31, 20X4.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Portia Ltd. acquired 80% of Siro Ltd.

Q32: On December 31, 20X6, the statements

Q33: A parent company chooses to acquire only

Q34: Taguchi Ltd. owns 80% of Shag

Q35: Under IAS 27, where does the non-controlling

Q36: Arnez Ltd. acquired 70% of Bedard Ltd.

Q37: On December 31, 20X2, Dark Company

Q38: Amber Ltd. purchased 80% of Patel Ltd.

Q40: Under ASPE reporting requirements for investments in

Q41: Fleming Ltd. acquired 75% of Donner Ltd.