Essay

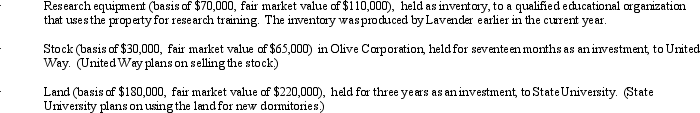

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

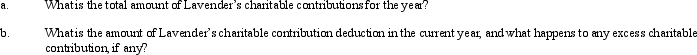

Correct Answer:

Verified

Correct Answer:

Verified

Q58: What is the annual required estimated tax

Q76: As a general rule, a personal service

Q80: Ed, an individual, incorporates two separate businesses

Q103: Grocer Services Corporation (a calendar year taxpayer),

Q104: Thrush Corporation files Form 1120, which reports

Q107: Beige Company has approximately $250,000 in net

Q108: Albatross, a C corporation, had $125,000 net

Q109: During the current year, Coyote Corporation (a

Q110: During the current year, Shrike Company had

Q112: Bjorn owns a 60% interest in an