Multiple Choice

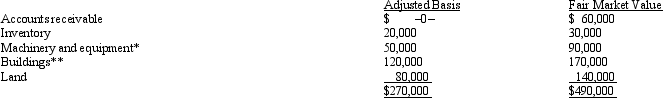

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Beige, Inc., has 3,000 shares of stock

Q33: Brenda contributes appreciated property to her business

Q40: If an S corporation distributes appreciated property

Q64: Eagle, Inc., a C corporation, distributes $250,000

Q67: Kirby, the sole shareholder of Falcon, Inc.,

Q68: Marsha is going to contribute the following

Q71: If the amounts are reasonable, salary payments

Q72: For a limited liability company with 100

Q73: Blue, Inc., has taxable income before salary

Q74: Colin and Reed formed a business entity