Essay

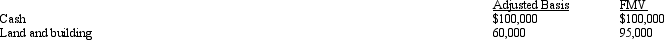

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Beige, Inc., has 3,000 shares of stock

Q33: Brenda contributes appreciated property to her business

Q40: If an S corporation distributes appreciated property

Q64: Eagle, Inc., a C corporation, distributes $250,000

Q67: Kirby, the sole shareholder of Falcon, Inc.,

Q69: Mr. and Ms. Smith's partnership owns the

Q71: If the amounts are reasonable, salary payments

Q72: For a limited liability company with 100

Q73: Blue, Inc., has taxable income before salary

Q150: Which of the following special allocations are