Multiple Choice

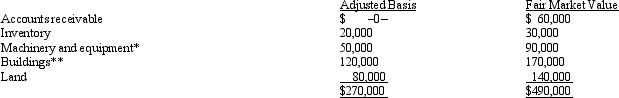

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Only C corporations are subject to the

Q29: Ralph owns all the stock of Silver,

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Wren, Inc. is owned by Alfred (30%)

Q33: Carol is a 60% owner of a

Q33: Actual dividends paid to shareholders result in

Q35: Barb and Chuck each own one-half of

Q36: Lime, Inc., has taxable income of $330,000.

Q37: A business entity has appreciated land (basis

Q39: Terry has a 20% ownership interest in