Essay

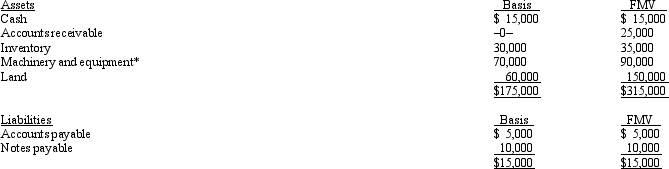

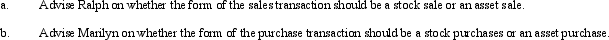

Ralph owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Ralph founded Silver 12 years ago. The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser, Marilyn, have agreed to a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Only C corporations are subject to the

Q26: Match the following statements:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg" alt="Match

Q27: Amber, Inc., has taxable income of $212,000.

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Wren, Inc. is owned by Alfred (30%)

Q33: Carol is a 60% owner of a

Q34: Kristine owns all of the stock of

Q53: A C corporation offers greater flexibility in

Q65: List some techniques which can be used

Q124: Why are S corporations not subject to