Essay

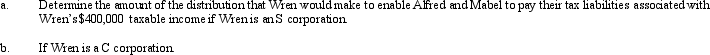

Wren, Inc. is owned by Alfred (30%) and Mabel (70%). Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%. Wren's taxable income for 2011 is $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Only C corporations are subject to the

Q27: Amber, Inc., has taxable income of $212,000.

Q29: Ralph owns all the stock of Silver,

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q33: Carol is a 60% owner of a

Q34: Kristine owns all of the stock of

Q35: Barb and Chuck each own one-half of

Q36: Lime, Inc., has taxable income of $330,000.

Q37: A business entity has appreciated land (basis

Q124: Why are S corporations not subject to