Related Questions

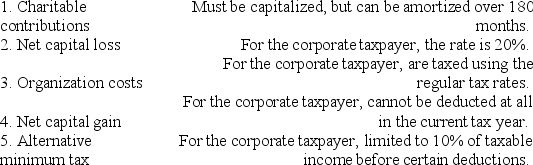

Q16: Only C corporations are subject to the

Q23: Barb and Chuck each own one-half the

Q27: Amber, Inc., has taxable income of $212,000.

Q29: Ralph owns all the stock of Silver,

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q34: An S corporation has a lesser degree

Q53: A C corporation offers greater flexibility in

Q65: List some techniques which can be used

Q94: Aubrey has been operating his business as

Q124: Why are S corporations not subject to