Multiple Choice

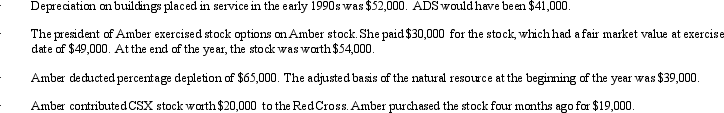

Amber, Inc., has taxable income of $212,000. In addition, Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Only C corporations are subject to the

Q23: Barb and Chuck each own one-half the

Q26: Match the following statements:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg" alt="Match

Q29: Ralph owns all the stock of Silver,

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Wren, Inc. is owned by Alfred (30%)

Q34: An S corporation has a lesser degree

Q53: A C corporation offers greater flexibility in

Q65: List some techniques which can be used

Q124: Why are S corporations not subject to