Related Questions

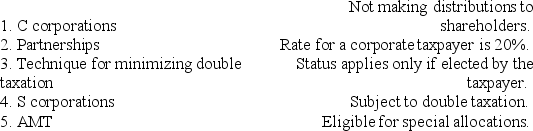

Q37: The AMT tax rate for a C

Q82: A corporation can avoid the accumulated earnings

Q84: If a C corporation has earnings and

Q97: Eagle, Inc. recognizes that it may have

Q98: Gladys contributes land with an adjusted basis

Q100: Ralph wants to purchase either the stock

Q104: A limited liability company (LLC) can elect

Q107: C corporations and S corporations can generate

Q107: In calculating the owner's initial basis for

Q138: Nontax factors are less important than tax