Essay

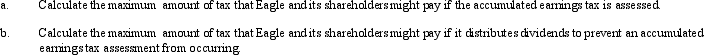

Eagle, Inc. recognizes that it may have an accumulated earnings tax problem. According to its calculation, Eagle anticipates it has accumulated taxable income, before reduction for dividends paid, of $600,000 in 2011. Assume that its shareholders are in the 35% marginal tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: To the extent of built-in gain or

Q84: If a C corporation has earnings and

Q92: Rocky and Sandra (shareholders) each loan Eagle

Q94: A limited liability company:<br>A) Could be subject

Q95: Albert and Bonnie each own 50% of

Q96: Ashley contributes property to the TCA Partnership

Q98: Gladys contributes land with an adjusted basis

Q100: Ralph wants to purchase either the stock

Q102: Match the following statements:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg" alt="Match

Q138: Nontax factors are less important than tax