Essay

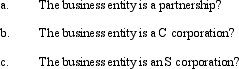

Gladys contributes land with an adjusted basis of $70,000 and a fair market value of $100,000 to a business entity in which she is an 80% owner on the first day of the tax year. Discuss the tax consequences to Gladys if the business entity sells the land six months later for $130,000 if:

Correct Answer:

Verified

Correct Answer:

Verified

Q38: To the extent of built-in gain or

Q84: If a C corporation has earnings and

Q94: A limited liability company:<br>A) Could be subject

Q95: Albert and Bonnie each own 50% of

Q96: Ashley contributes property to the TCA Partnership

Q97: Eagle, Inc. recognizes that it may have

Q100: Ralph wants to purchase either the stock

Q102: Match the following statements:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg" alt="Match

Q107: C corporations and S corporations can generate

Q138: Nontax factors are less important than tax