Essay

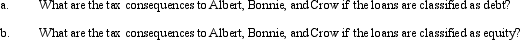

Albert and Bonnie each own 50% of the stock of Crow, Inc. (a C corporation). To cover what is perceived as temporary working capital needs, each shareholder loans Crow $150,000 with an annual interest rate of 5% (same as the Federal rate) and a maturity date of one year. The loan is made at the beginning of 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: To the extent of built-in gain or

Q62: List some techniques for reducing and/or avoiding

Q90: Marcus contributes property with an adjusted basis

Q92: Rocky and Sandra (shareholders) each loan Eagle

Q94: A limited liability company:<br>A) Could be subject

Q96: Ashley contributes property to the TCA Partnership

Q97: Eagle, Inc. recognizes that it may have

Q98: Gladys contributes land with an adjusted basis

Q100: Ralph wants to purchase either the stock

Q138: Nontax factors are less important than tax