Essay

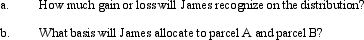

The JIH Partnership distributed the following assets to partner James in a proportionate liquidating distribution in which the partnership is liquidated: $25,000 cash, land parcel A (basis of $5,000, fair market value of $30,000), and land parcel B (basis of $5,000, fair market value of $15,000). James's basis in his partnership interest was $85,000 immediately before the distribution.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Martin has a basis in a partnership

Q16: Josh has a 25% capital and profits

Q17: Pat is a 40% member of the

Q19: Which of the following is not true

Q20: Chelsea owns a 25% capital and profits

Q25: Tom and Terry are equal owners in

Q27: On December 31 of last year,Rachel gave

Q36: Which of the following statements, if any,

Q126: If a partnership incorporates, it is always

Q175: For Federal income tax purposes, a distribution