Essay

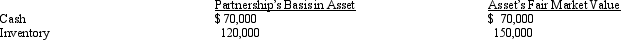

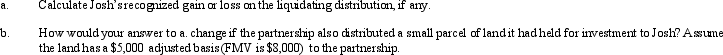

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership. His adjusted basis for his partnership interest on October 15 of the current year is $300,000. On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Martin has a basis in a partnership

Q15: The JIH Partnership distributed the following assets

Q17: Pat is a 40% member of the

Q19: Which of the following is not true

Q20: Chelsea owns a 25% capital and profits

Q25: Tom and Terry are equal owners in

Q27: On December 31 of last year,Rachel gave

Q36: Which of the following statements, if any,

Q95: A partnership has accounts receivable with a

Q126: If a partnership incorporates, it is always