Essay

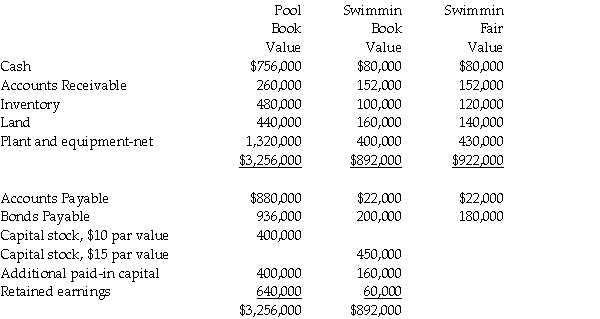

Pool Industries paid $540,000 to purchase 75% of the outstanding stock of Swimmin Corporation, on December 31, 2014. Any excess fair value over the identified assets and liabilities is attributed to goodwill. The following year-end information was available just before the purchase:

Using the data provided above, assume that Pool decided rather than paying $540,000 cash, Pool issued 10,000 shares of their own stock to the owners of Swimmin. At the time of issue, the $10 par value stock had a market value of $60 per share.

Using the data provided above, assume that Pool decided rather than paying $540,000 cash, Pool issued 10,000 shares of their own stock to the owners of Swimmin. At the time of issue, the $10 par value stock had a market value of $60 per share.

Required: Prepare Pool's consolidated balance sheet on December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pal Corporation paid $5,000 for a 60%

Q5: Pinata Corporation acquired an 80% interest in

Q6: On January 1, 2014, Packaging International purchased

Q7: Which method must be used if FASB

Q8: Pool Industries paid $540,000 to purchase 75%

Q9: Polaris Incorporated purchased 80% of The Solar

Q10: Petra Corporation paid $500,000 for 80% of

Q16: A newly acquired subsidiary had pre-existing goodwill

Q37: Percy Inc.acquired 80% of the outstanding stock

Q39: Pomograte Corporation bought 75% of Sycamore Company's