Essay

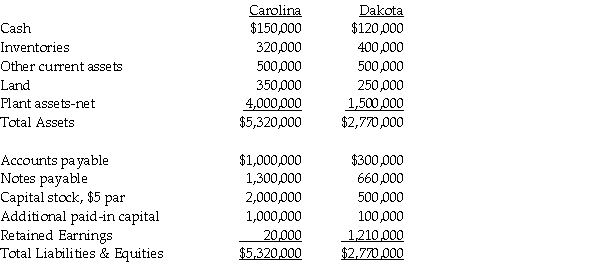

On January 2, 2013 Carolina Clothing issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Dakota Dressing Company's outstanding common shares in an acquisition. Carolina paid $15,000 for registering and issuing securities and $10,000 for other direct costs of the business combination. The fair value and book value of Dakota's identifiable assets and liabilities were the same. Assume Dakota Company is dissolved on the date of the acquisition. Summarized balance sheet information for both companies just before the acquisition on January 2, 2013 is as follows:

Required:

Required:

Prepare a balance sheet for Carolina Clothing immediately after the business combination.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Picasso Co.issued 5,000 shares of its $1

Q10: Historically,much of the controversy concerning accounting requirements

Q22: Following the accounting concept of a business

Q27: Bigga Corporation purchased the net assets of

Q27: In reference to the FASB disclosure requirements

Q30: Pali Corporation exchanges 200,000 shares of newly

Q33: Saveed Corporation purchased the net assets of

Q34: Use the following information to answer the

Q36: On January 2, 2013, Pilates Inc. paid

Q37: A business merger differs from a business