Essay

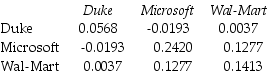

Use the table for the question(s)below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Microsoft and a $4000 investment in Wal-Mart stock is closest to:

Correct Answer:

Verified

Total invested = $6000 + $4000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Use the information for the question(s)below.<br>Sisyphean industries

Q12: Use the table for the question(s)below.<br>Consider the

Q14: Use the table for the question(s)below.<br>Consider the

Q49: Use the following information to answer the

Q58: Use the information for the question(s)below.<br>Suppose you

Q68: Which of the following statements is FALSE?<br>A)A

Q70: Use the table for the question(s)below.<br>Consider the

Q80: Use the following information to answer the

Q81: Use the following information to answer the

Q96: Suppose over the next year Ball has