Essay

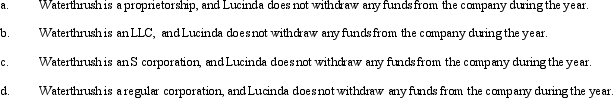

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Under the check-the-box Regulations, a two-owner LLC

Q21: What is a limited liability company? What

Q99: Bear Corporation has a net short-term capital

Q101: Rose is a 50% partner in Wren

Q102: Almond Corporation, a calendar year C corporation,

Q103: During the current year, Kingbird Corporation (a

Q106: Ivory Corporation, a calendar year, accrual method

Q107: Grebe Corporation, a closely held corporation that

Q108: If a C corporation uses straight-line depreciation

Q109: Elk, a C corporation, has $370,000 operating