Essay

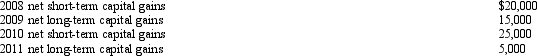

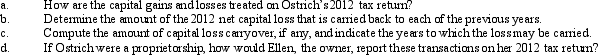

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An expense that is deducted in computing

Q21: Double taxation of corporate income results because

Q68: Canary Corporation, an accrual method C corporation,

Q69: During the current year, Owl Corporation (a

Q70: Compare the basic tax and nontax factors

Q75: Jade Corporation, a C corporation, had $100,000

Q76: As a general rule, a personal service

Q77: Warbler Corporation, an accrual method regular corporation,

Q79: No dividends received deduction is allowed unless

Q89: In the current year,Oriole Corporation donated a