Essay

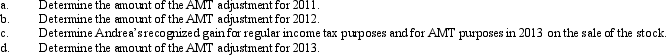

In May 2011, Egret, Inc.issues options to Andrea, a corporate officer, to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued, the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2012.Andrea exercises the options in November 2011 when the stock is selling for $1,600 per share.She sells the stock in December 2013 for $1,800 per share.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The deduction for personal and dependency exemptions

Q40: How can interest on a private activity

Q115: Evan is a contractor who constructs both

Q115: Will all AMT adjustments reverse? That is,do

Q116: Kaya is in the 33% marginal tax

Q117: Mitch, who is single and has no

Q118: Ashly is able to reduce her regular

Q121: What is the relationship between taxable income

Q122: Prior to the effect of the tax

Q123: The recognized gain for regular income tax