Multiple Choice

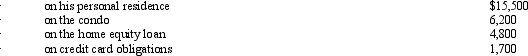

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2012, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2012, he paid the following amounts of interest:  What amount, if any, must Ted recognize as an AMT adjustment in 2012?

What amount, if any, must Ted recognize as an AMT adjustment in 2012?

A) $0.

B) $4,800.

C) $6,200.

D) $11,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If Jessica exercises an ISO and disposes

Q32: Which of the following statements is correct?<br>A)A

Q33: Use the following selected data to calculate

Q35: Prior to the effect of tax credits,

Q37: Andrea, who is single, has a personal

Q38: Luke's itemized deductions in calculating taxable income

Q39: Tricia sold land that originally cost $105,000

Q40: Under what circumstances are corporations exempt from

Q41: On January 3, 1998, Parrot Corporation acquired

Q69: Discuss the tax year in which an