Essay

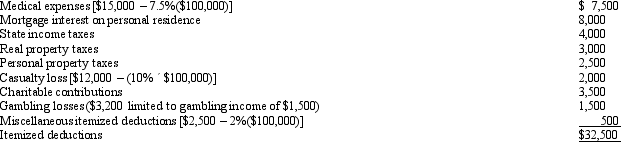

Luke's itemized deductions in calculating taxable income are as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: Use the following selected data to calculate

Q35: Prior to the effect of tax credits,

Q36: Ted, who is single, owns a personal

Q37: Andrea, who is single, has a personal

Q39: Tricia sold land that originally cost $105,000

Q40: Under what circumstances are corporations exempt from

Q41: On January 3, 1998, Parrot Corporation acquired

Q42: Can AMT adjustments and preferences be both

Q43: Tammy expensed mining exploration and development costs

Q69: Discuss the tax year in which an