Essay

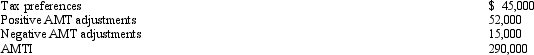

Use the following selected data to calculate Devon's taxable income.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: If Jessica exercises an ISO and disposes

Q28: If the taxpayer elects to capitalize intangible

Q30: Keosha acquires 10-year personal property to use

Q32: Which of the following statements is correct?<br>A)A

Q35: Prior to the effect of tax credits,

Q36: Ted, who is single, owns a personal

Q37: Andrea, who is single, has a personal

Q38: Luke's itemized deductions in calculating taxable income

Q54: If a taxpayer deducts the standard deduction

Q69: Discuss the tax year in which an