Multiple Choice

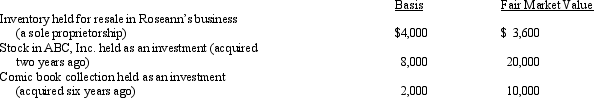

In 2012, Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Shirley pays FICA (employer's share)on the wages

Q28: A taxpayer pays points to obtain financing

Q31: Paul and Patty Black are married and

Q32: During 2012, Kathy, who is self-employed, paid

Q34: Ron and Tom are equal owners in

Q37: During 2012, Nancy paid the following taxes:

Q38: Tom is advised by his family physician

Q44: Harry and Sally were divorced three years

Q61: Letha incurred a $1,600 prepayment penalty to

Q66: Contributions to public charities in excess of