Multiple Choice

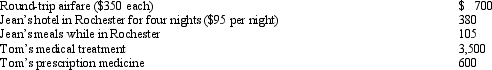

Tom is advised by his family physician that he needs back surgery to correct a problem from his last back surgery. Since Tom is in a wheel chair, he needs his wife, Jean, to accompany him on his trip to Rochester, Minnesota, for in-patient treatment at the Mayo Clinic, which specializes in this type of surgery. Tom incurred the following costs:  Compute Tom's medical expenses for the trip (subject to the 7.5% floor) .

Compute Tom's medical expenses for the trip (subject to the 7.5% floor) .

A) $4,000.

B) $5,000.

C) $5,180.

D) $5,285.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: In 2012, Roseann makes the following donations

Q34: Ron and Tom are equal owners in

Q37: During 2012, Nancy paid the following taxes:

Q39: For all of 2012, Aaron (a calendar

Q40: Any personal expenditures not specifically allowed as

Q41: George is single, has AGI of $255,300,

Q42: In 2012, Shirley sold her personal residence

Q43: David, a single taxpayer, took out a

Q61: Letha incurred a $1,600 prepayment penalty to

Q66: Contributions to public charities in excess of