Multiple Choice

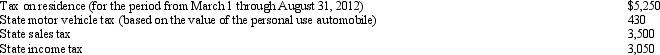

During 2012, Nancy paid the following taxes:  Nancy sold her personal residence on June 30, 2012, under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2012 for Nancy?

Nancy sold her personal residence on June 30, 2012, under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2012 for Nancy?

A) $9,180.

B) $9,130.

C) $7,382.

D) $5,382.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: During 2012, Kathy, who is self-employed, paid

Q33: In 2012, Roseann makes the following donations

Q34: Ron and Tom are equal owners in

Q38: Tom is advised by his family physician

Q39: For all of 2012, Aaron (a calendar

Q40: Any personal expenditures not specifically allowed as

Q41: George is single, has AGI of $255,300,

Q42: In 2012, Shirley sold her personal residence

Q61: Letha incurred a $1,600 prepayment penalty to

Q66: Contributions to public charities in excess of