Multiple Choice

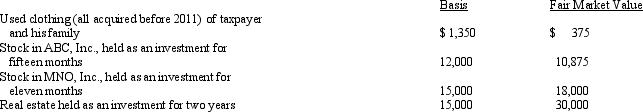

Zeke made the following donations to qualified charitable organizations during 2012:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: For calendar year 2012, Jon and Betty

Q7: Timothy suffers from heart problems and, upon

Q8: Fred and Lucy are married and together

Q9: On December 31, 2012, Lynette used her

Q10: In January 2013, Pam, a calendar year

Q12: Chad pays the medical expenses of his

Q13: Pat died this year.Before she died, Pat

Q15: Your friend Scotty informs you that he

Q16: Donald owns a principal residence in Chicago,

Q98: Fees for automobile inspections, automobile titles and