Essay

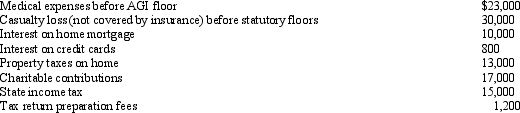

For calendar year 2012, Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Correct Answer:

Verified

For the medical expenses, the taxpayers ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Jerry pays $5,000 tuition to a parochial

Q2: During the current year, Maria and her

Q4: Georgia contributed $2,000 to a qualifying Health

Q5: Matt, a calendar year taxpayer, pays $11,000

Q7: Timothy suffers from heart problems and, upon

Q8: Fred and Lucy are married and together

Q9: On December 31, 2012, Lynette used her

Q10: In January 2013, Pam, a calendar year

Q11: Zeke made the following donations to qualified

Q48: Judy paid $40 for Girl Scout cookies