Essay

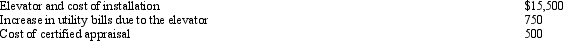

Timothy suffers from heart problems and, upon the recommendation of a physician, has an elevator installed in his personal residence. In connection with the elevator, Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

Correct Answer:

Verified

Only $13,500 qualifies for the installat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: During the current year, Maria and her

Q4: Georgia contributed $2,000 to a qualifying Health

Q5: Matt, a calendar year taxpayer, pays $11,000

Q6: For calendar year 2012, Jon and Betty

Q8: Fred and Lucy are married and together

Q9: On December 31, 2012, Lynette used her

Q10: In January 2013, Pam, a calendar year

Q11: Zeke made the following donations to qualified

Q12: Chad pays the medical expenses of his

Q48: Judy paid $40 for Girl Scout cookies