Multiple Choice

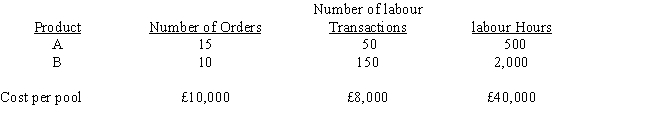

Zang Manufacturing Company manufactures two products (A and B) . The overhead costs (£58,000) have been divided into three cost pools that use the following activity cost drivers: What is the allocation rate per order using ABC?

A) £10,000

B) £2,320

C) £400

D) £58,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: An activity-based cost system<br>A)differs from a traditional-based

Q12: Figure 2<br>The management of Chott Industries predicted

Q13: Owens Ltd. produces specially machined parts. The

Q14: Product costs can be distorted if a

Q15: Committed resources<br>A) are supplied as needed.<br>B) are

Q17: More accurate product costing information is produced

Q18: Books Company manufactures and sells two products:

Q19: Godwin Ltd. produces specially machined parts. The

Q20: When selecting an activity driver, a company

Q54: Which of the following items would be