Multiple Choice

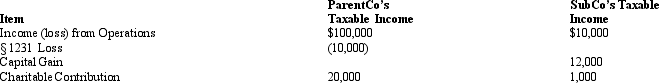

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000.

B) $100,800.

C) $112,000.

D) $122,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: SubCo sells an asset to ParentCo at

Q61: Business reasons, and not tax incentives, constitute

Q93: When a consolidated NOL is generated, each

Q94: When an affiliated group elects to file

Q120: Which of the following is not a

Q122: Which of the following items is not

Q126: Calendar year Parent Corporation acquired all of

Q127: All affiliates joining in a newly formed

Q128: The Parent consolidated group reports the following

Q130: The losses of a consolidated group member