Essay

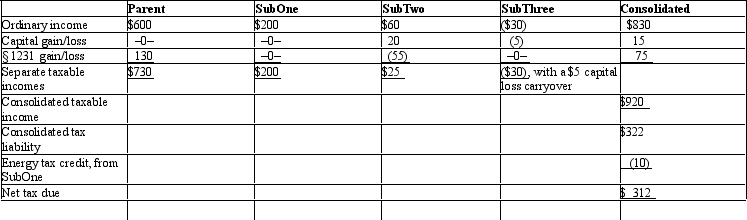

The Parent consolidated group reports the following results for the tax year.Determine each member's share of the consolidated tax liability,assuming that the members all have consented to use the relative tax liability tax-sharing method.Dollar amounts are listed in millions,and a 35% marginal income tax rate applies to all of the entities.

Correct Answer:

Verified

Consolidated tax lia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Conformity among the members of a consolidated

Q61: Business reasons, and not tax incentives, constitute

Q93: When a consolidated NOL is generated, each

Q94: When an affiliated group elects to file

Q125: ParentCo and SubCo had the following items

Q126: Calendar year Parent Corporation acquired all of

Q127: All affiliates joining in a newly formed

Q130: The losses of a consolidated group member

Q131: SubCo sells an asset to ParentCo at

Q132: A tax-exempt hospital cannot join in a