Essay

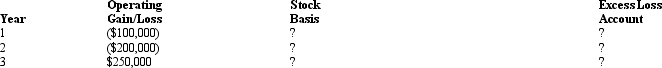

Calendar year Parent Corporation acquired all of the stock of SubCo on January 1,Year 1,for $400,000.The subsidiary's operating gains and losses are shown below.In addition,a $30,000 dividend is paid early in Year 2.

Complete the following chart,indicating the appropriate stock basis and excess loss account amounts.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: SubCo sells an asset to ParentCo at

Q61: Business reasons, and not tax incentives, constitute

Q93: When a consolidated NOL is generated, each

Q94: When an affiliated group elects to file

Q122: Which of the following items is not

Q125: ParentCo and SubCo had the following items

Q127: All affiliates joining in a newly formed

Q128: The Parent consolidated group reports the following

Q130: The losses of a consolidated group member

Q131: SubCo sells an asset to ParentCo at