Multiple Choice

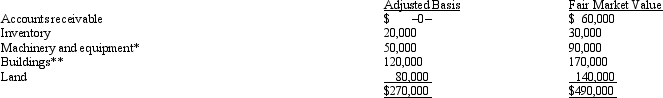

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: C corporations and their shareholders are subject

Q71: Candace, who is in the 33% tax

Q83: Of the corporate types of entities, all

Q100: Cory is going to purchase the assets

Q118: If the IRS reclassifies debt as equity

Q119: If lease rental payments to a noncorporate

Q121: A major benefit of the S corporation

Q122: Which of the following is not correct

Q123: Marsha is going to contribute the following

Q126: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's