Essay

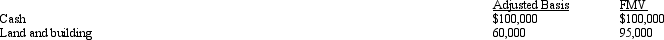

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

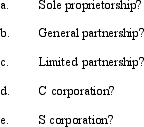

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: A limited partnership can indirectly avoid unlimited

Q29: C corporations and their shareholders are subject

Q71: Candace, who is in the 33% tax

Q83: Of the corporate types of entities, all

Q118: If the IRS reclassifies debt as equity

Q119: If lease rental payments to a noncorporate

Q121: A major benefit of the S corporation

Q122: Which of the following is not correct

Q124: Albert's sole proprietorship owns the following assets:

Q126: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's