Essay

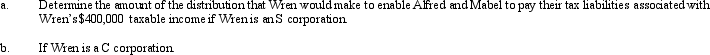

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%.Wren's taxable income for 2012 is $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q29: C corporations and their shareholders are subject

Q50: Melinda's basis for her partnership interest is

Q71: Candace, who is in the 33% tax

Q82: A corporation can avoid the accumulated earnings

Q100: Cory is going to purchase the assets

Q118: If the IRS reclassifies debt as equity

Q121: A major benefit of the S corporation

Q122: Which of the following is not correct

Q123: Marsha is going to contribute the following

Q124: Albert's sole proprietorship owns the following assets: