Essay

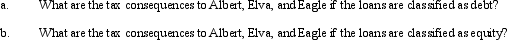

Albert and Elva each own 50% of the stock of Eagle,Inc.(a C corporation).To cover what is perceived as temporary working capital needs,each shareholder loans Eagle $200,000 with an annual interest rate of 6% (same as the Federal rate)and a maturity date of one year.The loan is made at the beginning of 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Section 1244 ordinary loss treatment is available

Q38: To the extent of built-in gain or

Q45: For a C corporation to be classified

Q53: A C corporation offers greater flexibility in

Q81: Colin and Reed formed a business entity

Q82: To which of the following entities does

Q84: Eagle,Inc.recognizes that it may have an accumulated

Q89: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q90: Nick owns 60% of the Agate Company

Q99: What is the major pitfall associated with